Whether you are about to graduate from dental school or are a well-established Oral Surgeon or Dentist, it is important to understand the types of coverage offered through a professional liability or dental malpractice insurance policy. The two types of dental malpractice policies may seem confusing at first or may seem like a technicality, but deciding which kind of policy is best for you is the biggest factor in purchasing a dental malpractice insurance policy.

Whether you are about to graduate from dental school or are a well-established Oral Surgeon or Dentist, it is important to understand the types of coverage offered through a professional liability or dental malpractice insurance policy. The two types of dental malpractice policies may seem confusing at first or may seem like a technicality, but deciding which kind of policy is best for you is the biggest factor in purchasing a dental malpractice insurance policy.

There are two kinds of dental malpractice insurance policies: Occurrence and Claims-Made. Occurrence policies protect you for treatment rendered during the policy period, no matter when a claim is reported. The policy that covers you is the one that was in force when the dental treatment occurred that resulted in a claim. In contrast, the claims-Made policy in force at the time the claim is reported to your insurance carrier is the policy that responds to the particular claim. Claims-Made coverage protects you for services performed from the time your coverage began, which is called the retroactive date. Each Claims-Made policy protects you only through the annual expiration date, so you must always renew your Claims-Made policy at expiration to be assured of continuous coverage spanning back to your retroactive date.

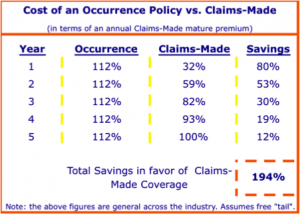

The cost of an occurrence policy is fixed year-to-year and is only affected by overall rate changes or underwriting. The cost is more than a Claims-Made policy due to the way that risk is calculated. In contrast, the cost of a Claims-Made policy starts low in the first year due to the fact that the risk of having a claim brought against you in the first year is minimal. As the years go by, the risk of a claim being brought against you increases, so the cost of the premium increases. After five years, this stair-step process ends and your premium levels off and is “mature”. The difference in cost over the five-year Claims-Made step period is approximately 194% more by choosing an occurrence policy. After the stair-step period has ended and going forward into the future, an annual occurrence policy typically costs 112% more than a “mature” Claims-Made policy.

The cost of an occurrence policy is fixed year-to-year and is only affected by overall rate changes or underwriting. The cost is more than a Claims-Made policy due to the way that risk is calculated. In contrast, the cost of a Claims-Made policy starts low in the first year due to the fact that the risk of having a claim brought against you in the first year is minimal. As the years go by, the risk of a claim being brought against you increases, so the cost of the premium increases. After five years, this stair-step process ends and your premium levels off and is “mature”. The difference in cost over the five-year Claims-Made step period is approximately 194% more by choosing an occurrence policy. After the stair-step period has ended and going forward into the future, an annual occurrence policy typically costs 112% more than a “mature” Claims-Made policy.

Down the road, if you want to switch insurance companies or retire, you will have to cancel your Claims-Made policy or let it expire. Claims-Made policies do not cover claims made after the termination of the policy, so you will need to purchase “Tail” coverage in these situations to ensure continuous coverage. A tail covers you for claims arising from treatment rendered between the retroactive date and the cancellation date, but which are reported after the policy has ended. Tail coverage is generally expensive, and some insurance companies offer a free tail at retirement, permanent disability or death based on certain conditions. If you are switching insurance companies, the new company will generally accept liability for claims based on incidents that happened under the old policy. They do this by keeping your retroactive date the same.

So which type of policy should you choose? It all depends. If you are working as an independent contractor and may change employers frequently in the future, you are better off with an occurrence policy. This is because you will not be able to take your policy with you to future employers and by purchasing an occurrence policy you will be able to avoid paying for a tail policy as required by a Claims-Made policy. If you plan to start your own practice or join a well-established practice and plan on staying there for a long time, you are better off with a Claims-Made policy. This is because you will be able to save significant dollars since the cost of the Claims-Made policy is less than that of an occurrence policy.

visibility_offDisable flashes

titleMark headings

settingsBackground Color

zoom_outZoom out

zoom_inZoom in

remove_circle_outlineDecrease font

add_circle_outlineIncrease font

spellcheckReadable font

brightness_highBright contrast

brightness_lowDark contrast

format_underlinedUnderline links

font_downloadMark links